Recently, actor Kim Seon Ho has been accused of tax evasion, with many accusing him of using a similar method linked to Cha Eunwoo, who is also under Fantagio.

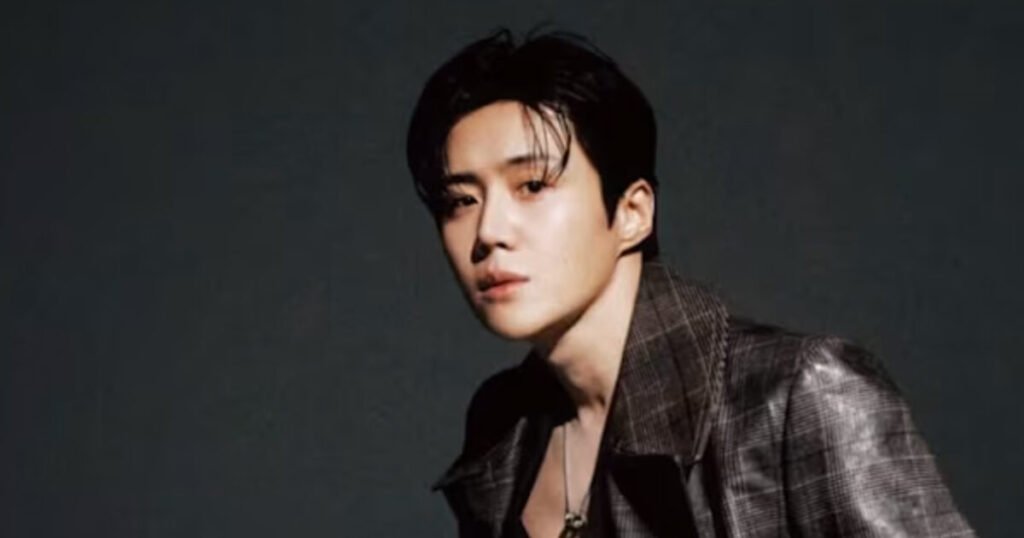

Kim Seon Ho’s Tax Evasion Scandal Sparks Demands To Kick Him Out Of Popular K-Drama

Following allegations that he operated a family-run corporation for tax evasion, Fantagio released a statement denying the claims.

We clearly state that there are no issues whatsoever regarding the contracts or activities of Kim Seon Ho and Fantagio. The former one-person corporation mentioned in the reports was established for theater production and theater-related activities, and was absolutely not created for the purpose of intentional tax reduction or tax evasion.

— Fantagio

Actor Kim Seon Ho Addresses Tax Evasion Accusations

However, on February 3, it was confirmed that Kim Seon Ho had been receiving his settlement through a one-person corporation, SH Do, established in January 2024 while under his previous agency.

His decision to receive settlement money through a family corporation is being speculated to be “tax laundering.” If his income is recorded as personal income, he is subject to income tax of up to 49.5%; however, if he treats it as corporate income, he receives a corporate tax benefit of up to 19%.

An official from his former agency stated, “We simply deposited the money into the account as the actor requested.”

This clearly constitutes tax evasion, not tax avoidance, but rather a deliberate attempt to divert funds from tax rates.

Head attorney Noh stated, “In light of the cases of Cha Eunwoo and Kim Seon Ho, income diversion through unregistered corporations is a key factor in undermining transparent accounting and tax management. Thorough investigations by authorities are more crucial than ever to eradicate tax evasion exploiting institutional loopholes.”

Kim Seon Ho also failed to register as a “popular culture and arts planning business”, a mandatory requirement.

Attorney Noh stated, “In the cases of Cha Eunwoo and Kim Seon Ho, the connection between unregistered businesses and the exploitation as a means of tax evasion by high-income celebrities is increasingly being revealed.”

Regarding this, Fantagio stated, “If is true that we temporarily received settlement (From the previous agency) after the establishment of the corporation.”